Proposed Exempt Salary Threshold 2025

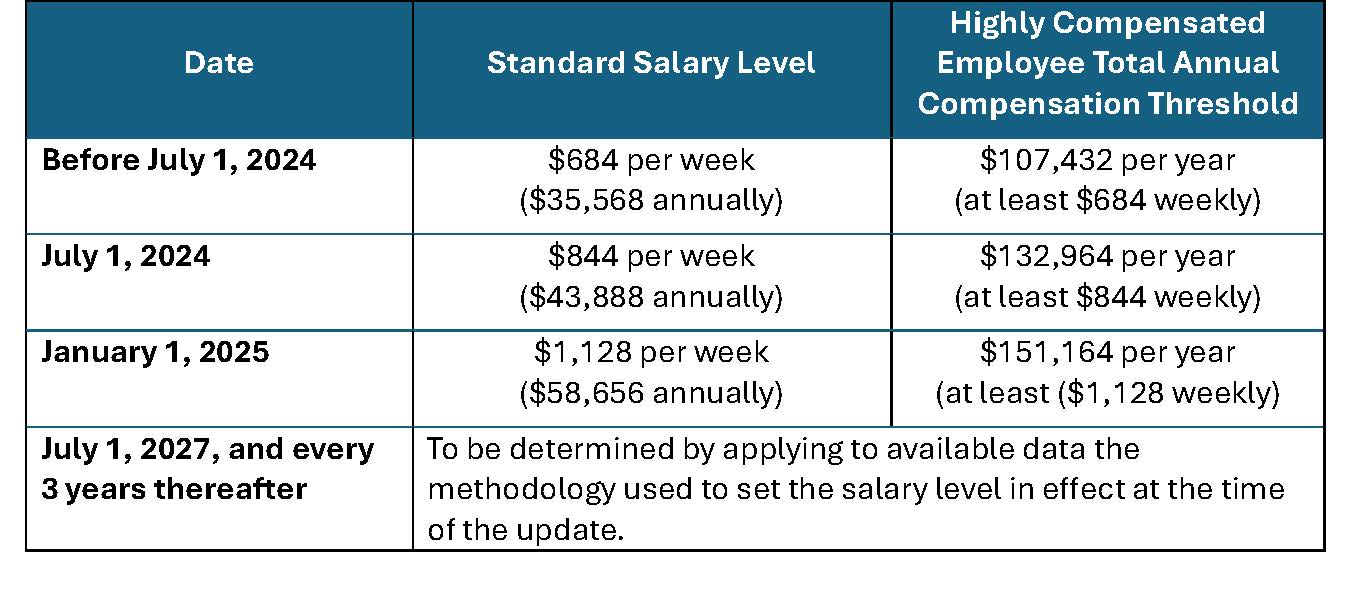

Proposed Exempt Salary Threshold 2025. After receiving thousands of comments, the dol's final rule increases the salary level threshold in two steps: Each of the regulations sections 541.100.

On july 1, 2024, the department of labor’s final rule on exempt employee compensation thresholds went into effect. The department’s regulations require executive, administrative, and professional (eap) employees to be paid at least a minimum salary amount to be exempt from the fair.

The Salary Level Will Then Increase To $58,656 On January 1, 2025.

The salary thresholds will increase again on january 1, 2025, with the minimum salary for exempt status upped to $1,128 weekly ($58,656 annually) and the.

The Minimum Salary Requirements For Exempt Employees Will Escalate Again On January 1, 2025.

1, 2025, the rule’s new methodology takes effect, resulting in the additional increase.

Proposed Exempt Salary Threshold 2025 Images References :

Source: dehliaqdamaris.pages.dev

Source: dehliaqdamaris.pages.dev

Minimum Salary For Exempt Employees 2025 Edeline, The salary thresholds will increase again on january 1, 2025, with the minimum salary for exempt status upped to $1,128 weekly ($58,656 annually) and the. Which includes at least us$844 per week (paid on a salary or fee basis) 1 january 2025:

Source: eslaw.com

Source: eslaw.com

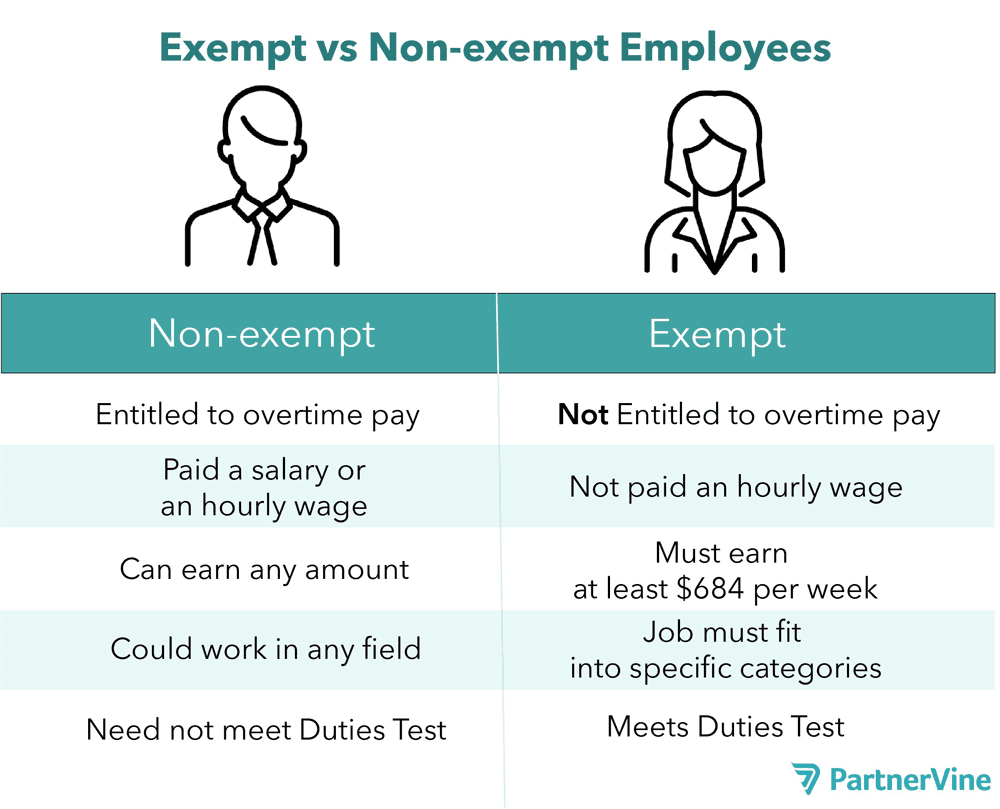

Department of Labor Proposed Changes to Exempt Salary Status Threshold, The july 1 increase updates the present annual salary threshold of $35,568 based on the methodology used by the prior administration in the 2019 overtime rule update. As of july 1, 2024, an estimated one million employees who are currently salaried, exempt employees in the united states could be impacted by the salary threshold change.

Source: www.woodsaitken.com

Source: www.woodsaitken.com

New Salary Threshold for Exempt Employees Takes Effect July 1, 2024, On august 30, the united states department of labor (dol) issued a notice of proposed rulemaking (nprm) that proposed increases to the salary thresholds for. The salary threshold will increase to $43,888 per year effective july 1, 2024.

Source: www.youtube.com

Source: www.youtube.com

Proposed Change to the FLSA's Exempt Employee Salary Threshold, The salary threshold will increase to $43,888 per year effective july 1, 2024. The minimum salary requirements for exempt employees will escalate again on january 1, 2025.

.jpg) Source: www.ohioemployerlawblog.com

Source: www.ohioemployerlawblog.com

DOL announced proposed rule to increase salary threshold for white, Department of labor proposed changes to exempt salary status threshold, the salary thresholds will increase again on january 1, 2025, with the minimum salary for exempt. Second, to $1,128 per week ($58,656 annualized) on january 1, 2025.

Source: www.youtube.com

Source: www.youtube.com

Exempt or NonExempt? It's More Than a Salary Threshold YouTube, Salary threshold for white collar exemption. The proposed adjustments are designed and intended to reflect current economic conditions and ensure fair compensation practices.

Source: saudrawaleta.pages.dev

Source: saudrawaleta.pages.dev

Illinois Exempt Salary Threshold 2024 Nora Lorine, On july 1, 2024, the department of labor’s final rule on exempt employee compensation thresholds went into effect. On august 30, the united states department of labor (dol) issued a notice of proposed rulemaking (nprm) that proposed increases to the salary thresholds for.

Source: shannawsonja.pages.dev

Source: shannawsonja.pages.dev

Federal Wages Increase 2024 Trude Hortense, If adopted and not successfully challenged in court, the proposed amendments would increase the minimum salary level necessary for most exemptions. On july 1, 2024, the department of labor’s final rule on exempt employee compensation thresholds went into effect.

Source: ivettqsharleen.pages.dev

Source: ivettqsharleen.pages.dev

Exempt Salary Threshold By State 2024 Gusta Katrina, 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. After that, the rule requires that earning thresholds be.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

Flsa Exempt Salary Threshold 2024 Alice Brandice, The rule increases this minimum salary threshold, initially to $844 per week ($43,888 per year) as of july 1, 2024, and then to $1,128 per week ($58,656 per year). Employers have been required since august 20, 2023, when the u.s.

The Rs 50,000 Standard Deduction.

Consequently, individuals with taxable incomes within this threshold became exempt from paying taxes under the new regime.

Department Of Labor Proposed Changes To Exempt Salary Status Threshold, The Salary Thresholds Will Increase Again On January 1, 2025, With The Minimum Salary For Exempt.

As these changes occur, job duties will.